Disruption of the Old Money Management Model

The money management industry, with assets under management globally reaching US$110 trillion (end-2020, PwC), is undergoing a seismic shift. The old model of active money management to pick individual stocks, bonds, or star managers is becoming obsolete and an unreliable source of return due to:

- Availability of Big Data, superior computer processing power, fast and instant communication, and proliferation of AI and Machine Learning (ML);

- Rise of financial innovations such as low-cost passive investing (ETFs/ETNs), active ETFs, and Robo Advisory; and

- Flurry of M&A activities driven by the race to the bottom of fees and digital transformation to enhance firm’s value as evidenced by FinTech deals hitting another record in Q2 2021.

All these have radically changed the investment landscape and destabilized the traditional mutual fund industry with digital transformation becoming a necessity and not a luxury for our industry. Oliver Wyman called out 2021 as the peak for the mutual fund industry as technology continues to reduce costs, the use of direct indexation, fractional shares, and overlays enables more customized portfolios, and mutual funds are converting to ETFs, making the mutual fund industry more obsolete.

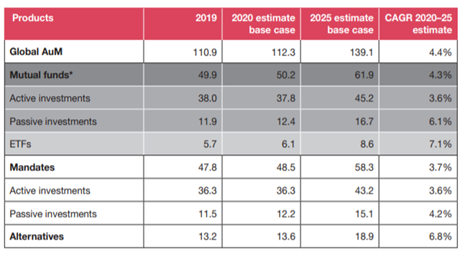

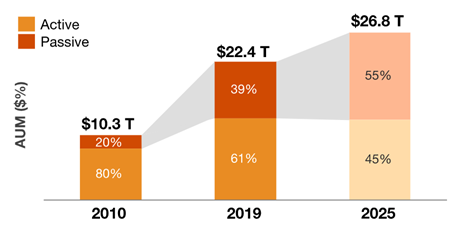

ETFs and passive mutual funds are expected to grow about twice the rate of active mutual funds during 2020-25E with total passive investments including ETFs to reach 30% of total global AUM (PwC). Within the U.S., by 2025, passive investments AUM would exceed that of active investments at 55% of total AUM.

Active Funds Disappoint while Detailed and Customized Asset Allocation is the Future

Traditionally, the two models of making money are security (stock) picking and asset allocation. But the truth is: 86% of U.S. active mutual fund managers have underperformed over the last 20 years (2021, SPIVA)! The primary reason for poor performance is that stock picking is quietly but relentlessly becoming obsolete as a model to outperform benchmarks. Given fast global communication, Big Data, and ML, relevant information on publicly-listed securities are assessed, broadcasted, and arbitraged away instantly, leaving limited scope for the “active” managers to outperform.

Together with the massive migration to cheaper, passively managed index-like products, the old model of money management i.e., stock picking, no longer works well. However, the scope for active, broad-based, and in-depth asset allocation has dramatically increased, radically improving from the old 60% stocks, 40% bonds standard. The 60% stock can now be “spread out” across numerous global markets, sectors, industries, factors, ETFs, etc., genuinely exploiting the diversification (of value). Thematic investing/ETFs – automation, robotics, new energy, broader ESG, health technology, etc. – that ride on future macro trends cutting across sectors and industries have trebled in AUMs since 2018. Active global and in-depth asset allocation is becoming the most effective investment style generating outstanding results.

Active and discretionary asset allocation in turn is a natural user of market intelligence, data, quant algorithm, and technology, i.e., a perfect candidate for Big Data and ML feeding in turn “Augmented Intelligence”. Thus, an automated interactive asset allocation platform will not only become a necessity for investment advisors eager to build in-house robust global investment capabilities at a very low cost but also will displace the old, expensive, and underperforming “active” fund industry.

Investment Advisors/Family Offices/Asset Managers Investment Workflow

Investment managers are generally tasked with four basic functions of investment: (1) Security selection (2) Asset allocation and portfolio construction (3) Risk management and ongoing rebalancing (4) Performance/Meeting investment goals.

For large money managers, the investment team consists of a Chief Investment Officer leading an army of analysts, portfolio managers, risk managers, and traders to identify investment strategy and positions, trade securities, and monitor positions and risks on an ongoing basis.

For the smaller and independent registered investment advisors (RIAs) and family offices, the manager may perform all of the above functions by herself. The RIAs need to spend their time understanding their client’s financial needs – risk profile, risk tolerance, financial capacity, market knowledge – thus creating financial plans that suit the client’s risk profiles and investment goals in addition to tax/estate planning and other administrative functions. For family offices and high net-worth clients, their chief investment need is usually capital preservation.

If building an investment infrastructure is complex and costly, financial advisors and family offices naturally streamline/outsource their investments. They can rely on model portfolios supplied by brokerage houses, banks, or turnkey asset management platforms (TAMPs), paying a hefty fee or through trading and custody; or they rely on fund complexes like Dimensional Funds and Fidelity, investment consultants, or Morningstar to pick active funds. More simply, they use the screeners at Vanguard, Fidelity, or BlackRock websites to pick ETFs based on a few filters.

The problem: the old model of security/manager picking does not work due to the poor performance of active funds. Wealth managers need tools for global asset allocation. The solution: an integrated digital investment in-house system that has the essential data, effective investment selection methodology, robust asset allocation/portfolio construction tools, and a sophisticated risk management system.

Evolution of Digital Advice

“No man is better than a machine, and no machine is better than a man with a machine”. Paul Tudor Jones.

Robo-advisory, an online and automated investment advisory service, has successfully transformed investment management and opened access to wealth management solutions for retail consumers. Robo-advisors features have evolved from simple online questionnaires (1.0) to ML algorithms (4.0) that help to rebalance and manage risk when risk appetite, liquidity, and the market environment shift (Deloitte). However, wealth managers need something more sophisticated and a lot more personalized. The most practical model is the Hybrid Model where the wealth managers tap into the data and tools of a digital investment system for easy creation of investment strategies and highly-tailored portfolios, all at their desktop while interacting holistically with their clients to ensure their investment goals, risk appetites and capacity, and values/purposes are met – what we call a “Virtual” CIO solution.

An Integrated and Effective Digital Investment System Helps Wealth Managers Build Better Portfolios

A digital investment solution must have several essential and integrated features to satisfy the modern registered investment advisors, family offices, and other institutional investors’ demanding mandates:

- Ability to identify and rank value and risk of investment opportunities globally based on a value metric that is universal, forward-looking, and unbiased.

- An asset allocation and portfolio construction system that is user-friendly, incorporates the manager’s subjective views and generates superior and best-outcome portfolios.

- A risk-management system flexible and sophisticated enough to match the client’s investment goals with risk, quantify risk as a permanent loss of capital (not confusing risk with volatility), and rebalance the portfolio based on ongoing market risk assessment and changes in the clients’ financial needs.

At Lumen Global Investments, we are building such digital investment solutions to translate complex money management processes into easy-to-use tools, enabling wealth managers to generate superior investment results independently, in real-time, with full control (open architecture), taking into account the client’s risk preference and capacity, goals, values, and purposes without paying exorbitant fees to third parties. Data-informed decision-making and digital technology can help improve investment consistency that better matches the client’s circumstances and removes unhelpful biases. The investments are filtered through the lens of intrinsic valuation (Lumen Compass) with enhanced portfolio construction and risk management techniques, with better return per risk profiles.

Learn more about Lumen’s three exclusive and acclaimed features.

Marianne O, July 2021, San Francisco