Global Backdrop:

- Global markets are at an unusually sharp inflection point reflecting an equally unusual convergence of uncertain geopolitical and public health outcomes markedly affecting economic activity and policy stances across advanced and emerging economies alike.

- The pandemic continues to rage with no end in sight. Irrespective of the number of confirmed infections globally, second and third waves pretty much everywhere are once again overloading health care infrastructures, thus renewing the need for stricter lockdowns and exerting a sizeable impact on employment, consumptions, and economic activity.

- Despite the political posturing, the fiscal policy measures desperately needed to provide a backstop to the economy are in short supply, reflecting a lack of political cohesion in major countries and leaving the heavy lifting primarily to monetary policy stances.

- Short term, the paramount source of market anxiety is by far the US election and its relevance to determine the developments not only in the United States but also around the global, e.g. global trade. Irrespective of the possibility of a long, drawn out brawl over the results, there is also a massive difference in the respective programs of the two candidates:

- The Trump Administration appears to rely on much of the same policies implemented over the past four years (there is unfortunately not much of a detailed political platform/program from the incumbent candidate), and that is: aggressive deregulation with the ultimate objective to increase productivity and the GDP potential growth rate (the 4% GDP growth rate touted by President Trump) and continued tax reduction paid for promising a cut in expenses and temporary fiscal deficits. The main trouble with this plan is that, most likely, the House of Representative will remain firmly in the Democrats’ hands and in charge of tax legislation, while deregulation so far seems to have failed in raising US productivity and/or bringing the growth rate close to 4 percent!

- Vice President Biden on the other hand has a much more detailed albeit ambitious program worth more than $4.5 trillion reportedly paid for primarily by a redistribution of the personal tax burden and an increase in corporate tax rate. The program also seems to be balanced and inclusive, addressing outstanding uncertainties (e.g. health care and social outlays), the environment, education, and infrastructures.

Investment Implications:

- Although it is never a good practice to construct an investment strategy based on political outcomes, we believe that this time around the polls may be correct in calling for a Biden win, possibly carrying the Senate as well (i.e., the Blue Wave scenario). Thus, this outcome calls for an aggressive portfolio exposed to growth, equally “spread” across cyclical sectors and sectors that will benefit from massive infrastructure investment, including new technology (e.g., EV national grids).

- In case we are wrong with our aggressive stance we feel that the downside may be limited. In the event of a Trump win and a divided Congress, we still believe that the pandemic will create enough of a consensus for a sizeable stimulus package and possibly a (much more) modest infrastructure package.

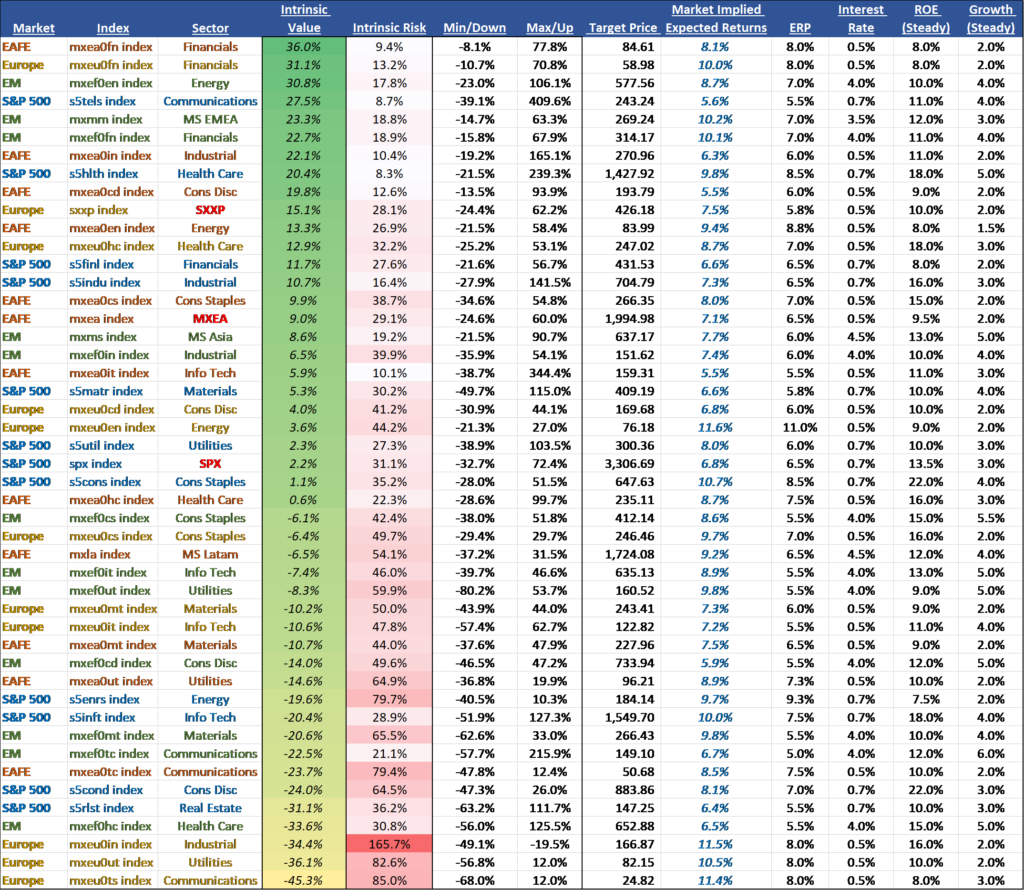

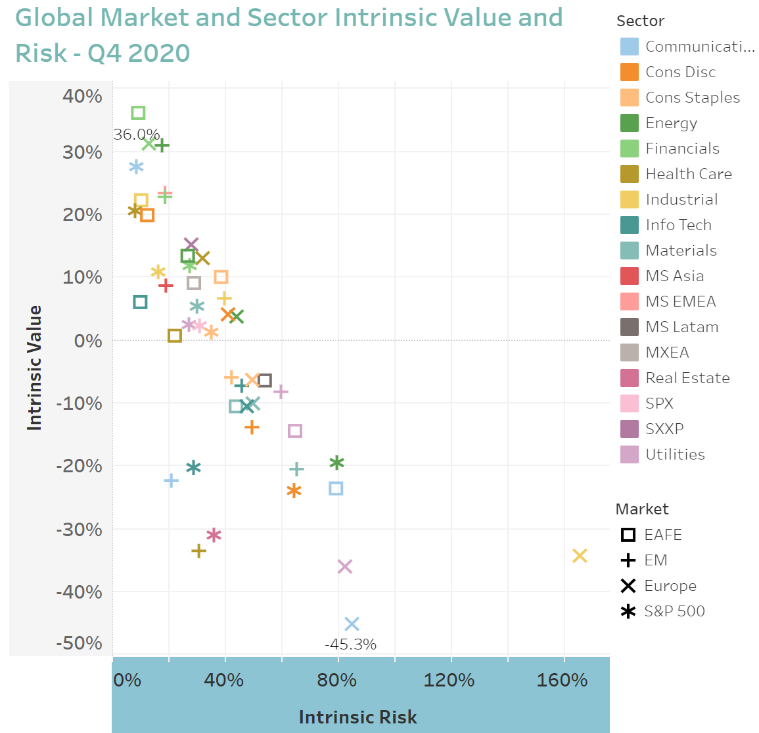

- Another reason justifying our aggressive stance is broad valuation, as we do not believe that the recent market rally has generated a bubble across all sectors. Zero-cost capital, historically wide Equity Risk Premium, expanding margins, impenetrable moats, growth “forever”, and tangible earnings in our view broadly justify the recent performance of the tech mega caps. Indeed, if anything, the market seems to have behaved rationally, with several sectors away from these mega caps lagging substantially … and leaving plenty of “value” for cyclical sectors that will benefit from more proactive policy stances.

- One such sector is financials and banks. The sector is not only attractively valued (having markedly lagged the broad market) but also bodes well to exploit the potential for an increase in inflation. Indeed, with short term interest rates firmly anchored by the central banks, inflation may result in “curve steepening”, thus helping banks to (finally!) widen their Net Interest Margins and ultimately profits.

Global Strategy (see Table 1):

- Our aggressive stance is also mitigated by a sizeable global diversification, with exposure to value strategies in Europe and growth strategies in Emerging Asia (Greater China).

- Indeed, while we do not believe that Europe will be a growth story anytime soon, we nonetheless expect that the pandemic resurgence and possibly a positive resolution on Brexit may generate sufficient momentum and consensus for sizeable and coordinated stimulus programs, thus providing the right backdrop for depressed valuations to recover.

- The same generalization may not apply to Emerging Markets. Latin America is once again burdened by high debts and low commodity prices amidst little political capital necessary to implement desperately needed structural reforms while the pandemic runs amok. Eastern Europe continue to remain fully dependent on growth in greater Europe (read German Export markets!), with little policy leeway and the straight jacket of fix exchange rates. Our best “pick” in the EM world remains Emerging Asia. The region not only has been successful in limiting the impact of the pandemic but also has substantial policy leeway – both monetary and fiscal – thus providing sufficient tools and options for the authorities to face any adverse global headwinds.

- We see zero value across virtually all fixed income in terms of carry, as an investment and safe haven.

- Of course, all the above could turn out to be academic in the event of generalized social unrests following unclear results of the US Presidential election. While we do not attach much probability to this scenario in light of the strength of US institutions, the very same fact that it is openly contemplated by the public press in what is often referred to as “the best democracy in the world” speaks volumes! In this dreadful scenario, the only savior/hedge in our view is to own plenty of gold!

October 2020, Lumen Global Investments, San Francisco

Contact snocera@lumenadvisors.com or marianneo@lumenadvisors.com for more information.